“改革开放”初期,时任中国领导人邓小平曾对“共同富裕”这一概念反复强调。

最近一次的中央会议对于共同富裕的概念进行了进一步详尽的探讨。转移支付、税收改革和慈善捐赠均在会议中成为讨论的焦点。在决策层对互联网独角兽公司剑指更高维度监管的背景下,许多公司纷纷选择慨慷解囊,扩大捐款规模,帮助偏远和欠发达地区实现共同富裕的目标。然而,波诡云谲的市场惊涛将中国许多科网巨头卷入史诗级的波动,也在投资者群体中造成相当程度的困惑。不过我们远没有如此悲观,我们坚信山穷水复的行情正在修复,终将迎来柳暗花明的前景。

早在2016年11月和2017年11月,我们分别撰写了两篇深度报告,重点关注收入和财富分配的不平等现象,并探讨当时这一分配不均的现状将如何导致需求不足和通货紧缩,以及其他未来很可能日渐瞩目的社会问题(请参阅《价格的革命》20161114和《破译低通胀的密码》20171114)。值得注意的是,2017年是中国“社会主要矛盾”被重新定义的一年。自那以后,中国最高收入和最低收入之间的比率在持续攀升十多年后终于趋稳。换言之,收入不平等的问题从那时起停止了恶化。

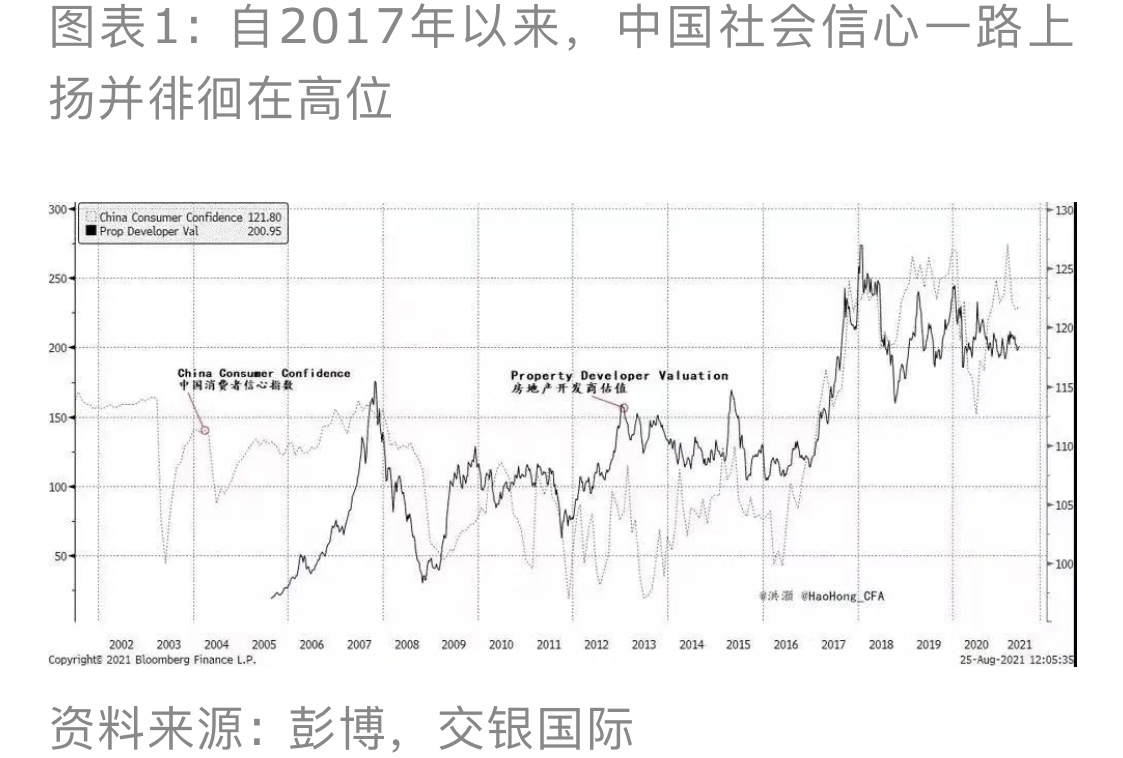

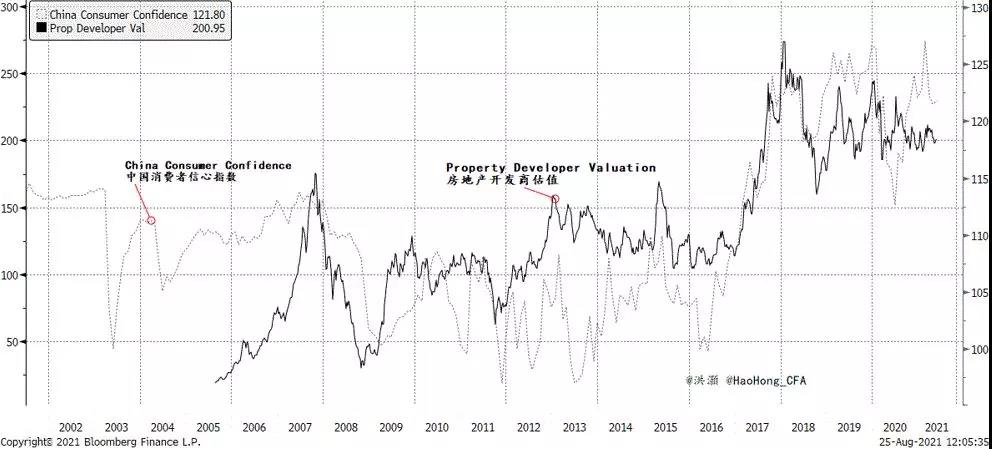

另外一种审视这一问题的方法是观察中国社会信心的变化,我们在这里以消费者信心为代表,并将其与房地产业主和开发商的估值进行比较(图表1)。

如图所示,中国社会信心自2016年减弱后,于2017年开始回升,此后保持一路走高的态势。与此同时,一个密切相关的指标——房地产业主和开发商的估值也在同步攀升。视觉上,现阶段这两项指标都处在2017年之前的时期无法与其等量齐观的较高水平。也就是说,正如数据所示,共同富裕促进了社会信心。自2017年重新定义社会主要矛盾以来,中国已经开始朝着这个目标努力奋进,而非今时今日才有所行动。这是一个已经持续数年的进程,亦可以从数据中看出来。而业主和开发商估值的并行上升也可以被视为一项指标,表明社会信心正从实现“共同富裕”的努力中得到提升。

如果是这样,为什么市场突然对“共同富裕”报以如此关注?

我们认为这个概念被外国投资者误解了。由于以在美国上市、在中国香港上市以及在A股上市的中国公司为代表的“中国市场”不止一个,我们可以通过对比这些不同公司群体的指数表现来判断部分投资者对于“共同富裕”存在误解。

在图表2中,我们比较了在美国上市的中国互联网公司(KWEB.US)、MSCI中国科技100指数、MSCI中国指数、创业板(中国的纳斯达克)和纳斯达克100指数(NDX)。我们可以看到它们之间的表现存在显著的差异——创业板和纳斯达克100指数处于高位,并在续创新高,而在美国上市的中国互联网公司和MSCI中国指数则表现不佳。由于中国创业板主要由国内投资者交易,而在美国上市的中国科技公司则由许多海外投资者持有,这些指数表现的分化表明,中国近期利好于未来长期远景的发展趋势,在某种程度上受到了海外投资者的误解。有些人甚至草率地宣称中国“不可投资”。恕我直言,我们并不同意这一观点。

我们是市场上最早指出科技股估值在今年2月泡沫化的分析者之一,并向投资者警示了泡沫即将破裂的风险(《展望2021:价值王者归来》,20201120)。现在,根据不同的指数计算,中国的科技股调整幅度从50%到远超60%不等,它们的估值也变得比以前合理多了。共同富裕并不是非自愿地重新分配人们现有的已经积累了的财富。它更多的是要通过一个更加公平的过程,让更多为中华民族伟大复兴做出巨大贡献的中国人一起分享经济发展的成果。而实现这一目标的途径有很多,比如资本利得税和未来的一些其他形式的再分配/转移支付。从不同投资者群体持有的指数之间表现的差异可以看出,对于中国倡导的“共同富裕”这个概念,海外与国内投资者的理解截然不同。很显然,未来国内投资者将是中国实现“共同富裕”这一伟大目标更大的赢家。难怪在中国离岸市场动荡之际,A股市场的指数基本上没有受到影响。

我们认为,在上周的抛售之后,恒生指数已经到达了一个重要的低点,如图表3所示。虽然未来恒指仍有可能出现第二个低点,但是长线投资者应该开始关注恒指的长期投资价值,并怀着这个大局观相应地布局。

以下是英文原版

----------------------

During the early days of China’s “Reform and Open”, Mr. Deng Xiaoping repeatedly emphasized the term “common prosperity”. In December 1990, he was conversing with the comrades working along his side at a meeting. Mr. Deng said: “We have been discussing ‘common prosperity’ since the inception of ‘Reform and Open’. One day in the future it will become a focal topic. Socialism is not about a few people getting rich while the majority stays poor. The foremost advantage of socialism is common prosperity, and it is one of the essences of socialism.” (second volume, The Governance of China)

At a recent central meeting, common prosperity was discussed in further details. Transfer payments, tax and charity were all discussed during the meeting. Amid the tightening oversight of the internet platform unicorns, many companies chose to expand their donations to help achieve the goal of common prosperity in the remote and less developed areas. Yet, market gyrations engulfing many of China’s biggest tech firms into epic volatility have caused much confusion among investors, leaving some foreign investors heading toward the exit. But we are far less pessimistic, and are confident that the prospects beyond the immediate term have indeed been improving.

As early as in November 2016 and again in November 2017, we had written two in-depth thought pieces about income and wealth inequity, and how the disparity in income and wealth distribution has contributed to insufficient demand and deflation, as well as other social issues that will likely become more glaring in the future (Please refer to “A Price Revolution” on 2016.11.14 and “Decoding Disinflation” on 2017.11.14). Note that 2017 is the year when the “principal social contradiction” was redefined. Since then, the ratio between the top and bottom incomes in China has stabilized, after rising for over a decade. That is, income inequity has indeed stopped worsening since then.

Another way to look at this is to examine the change in China’s social confidence, proxied here by consumer confidence, and then compare it with the valuation of property owners and developers (Figure 1).

Figure 1: Social confidence has been rising to an elevated plateau since 2017

Source: Bloomberg, BOCOM Int'l

As we can show, social confidence started to rise in 2017, after a dip in 2016, and remain elevated ever since then. Meanwhile, property owners and developers’ valuation, a closely correlated measure, has risen in tandem. Now, both measures are sitting at an elevated level that is visually incomparable to the period prior to 2017. That is, common prosperity promotes social confidence, as seen in data. And since 2017 when the principal social contradiction was redefined, China has started to work toward this goal, not today. It is a progress that has been ongoing for some years, and can be clearly seen in data. The concurrent rise in property owners and developers’ valuation can also be viewed as a measure that indicates improving social confidence from working toward “common prosperity”.

If so, why is the market suddenly so concerned about “common prosperity”?

We would argue that this term has been misconstrued by foreign investors. As there is more than one “China market” as represented by the US-listed Chinese companies, HK-listed and A-share-listed companies, we can gauge who has gotten the wrong message by simply contrasting the index performance of these different groups of companies.

Figure 2: Diverging performance of different “China market” tech indices

Source: Bloomberg, BOCOM Int'l

In Figure 2, we compare US-listed Chinese internet companies (KWEB US), MSCI China Tech Top 100 Index, MSCI China Index, ChiNext (China’s NASDAQ) and NASDAQ Top 100 (NDX). We can see significant divergence in performance between them – the ChiNext and the NASDAQ 100 are at the top and continue to make new highs, while the US-listed ones and MSCI China are underperforming. As the ChiNext is mostly traded by domestic investors, while the US-listed Chinese tech firms are held by many foreign investors, such divergence in their performance suggests that the latest developments in China that augurs well for the country in the long term are somewhat misconstrued by foreign investors. Some even were hasty to declare China “un-investable”. Respectfully, we disagree.

We were among the first to point out that tech valuation in February was a bubble, and warned of an impending burst (“Value Strikes Back”, 2020.11.20). Now, depending on which index you use, China’s tech firms have corrected 50% to well over 60%, and their valuation has become more agreeable. Common prosperity is not to redistribute the existing accumulated wealth involuntarily. It is more about devising a fairer process in which the fruits of economic development can be shared by more Chinese people who have contributed greatly to the revival of China’s economic and cultural prominence. And there are many ways to achieve this goal, such as capital gain tax and some other forms of redistribution/transfer payment in the future. The interpretation of foreign investors versus domestic ones, as seen in the diverging performance between the indices held by different groups of investors, corresponds to the different beneficiaries of the changes toward “common prosperity”, with domestic investors being the clear winners going forward. No wonder the A-share indices have remained mostly unfazed amid the turmoil in the offshore Chinese stocks.

We believe the Hang Seng has reached an important low after last week’s selloff, as seen in Figure 3. While a second, higher low is possible, long-term investors should start thinking about the long term, and deploy capital accordingly.

Figure 3: The Hang Seng has reached an important low after last week’s selloff